The millions of people who have taken part in the Berkshire Hathaway Annual Meeting have been honored by interesting news: who will be the company’s next CEO.

Berkshire Vice Chairman Charlie Munger made a statement that, on the surface, wasn’t all that shocking in response to a query on Saturday about whether the business would ultimately become too difficult to handle.

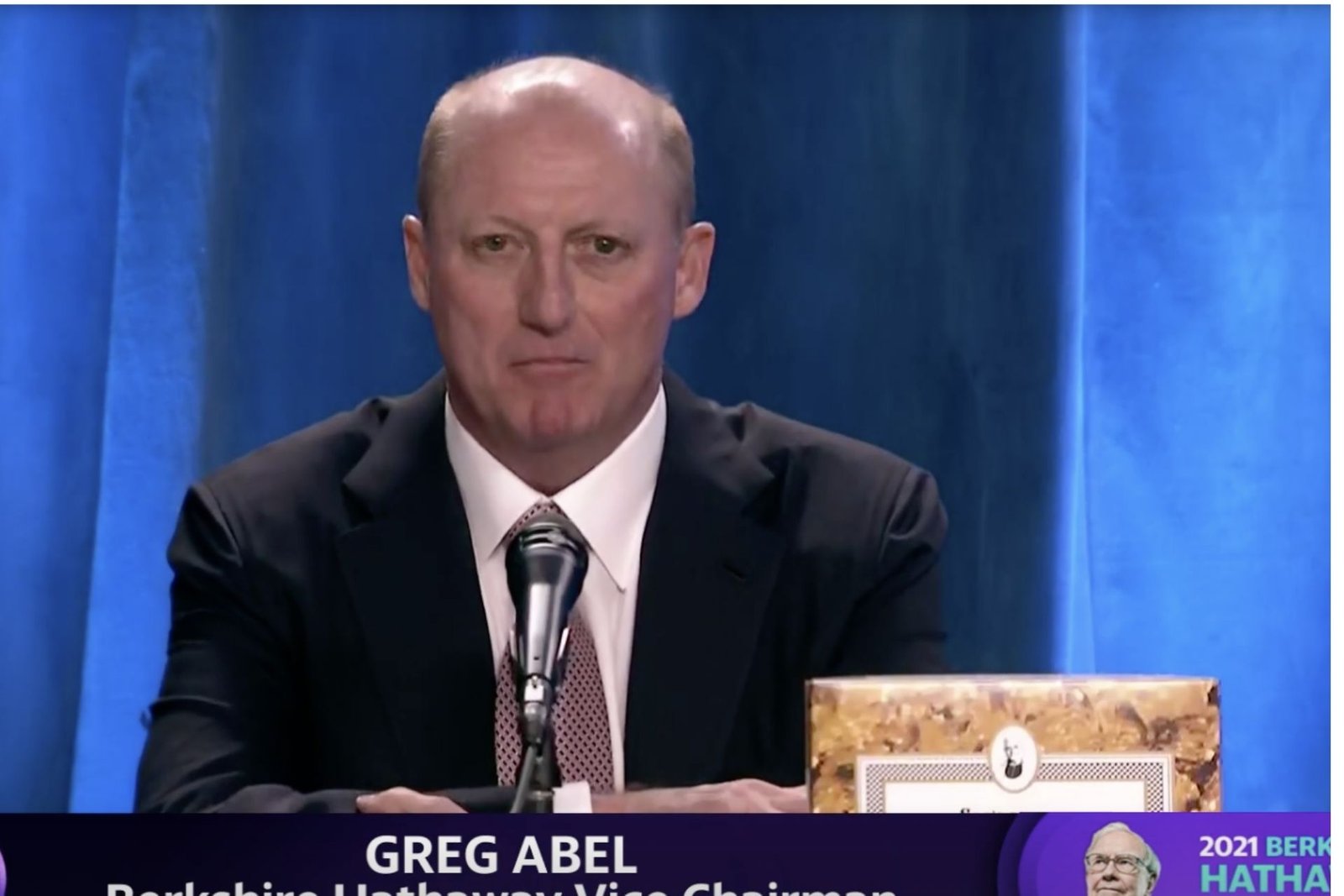

The 97-year-old Munger plainly said, “Greg will keep the culture,” explaining that the company’s decentralized existence will outlast him and Warren Buffett.

But it was enough to pique the interest of some Berkshire watchers, who had been curious about the conglomerate’s succession plans once Chairman and CEO Warren Buffett, who is 90 years old, steps down. Many believed it meant Vice Chairman Greg Abel, who oversees all non-insurance activities, will take over as CEO.

CNBC may confirm that the impression was right.

“The directors have agreed that if anything happened to me tonight, Greg will take over first thing the next morning,” Buffett said. He thanked Abel and Berkshire’s Vice Chairman Ajit Jain, who oversees the company’s insurance activities.

Since their promotion to vice chairmen in 2018, both have been considered candidates for the top role. “If something were to happen to Greg tonight, it would be Ajit,” Buffett said, noting that age is a deciding factor for the board. Abel is 59 years old, and Jain is 69 years old. “They’re both great people. The possibility of someone getting a 20-year runway, on the other hand, makes a significant difference.”

For over 15 years, the issue of who will succeed Buffett has been a topic of speculation. For years, it was thought that David Sokol, who operated MidAmerican Energy, now Berkshire Hathaway Energy, and Berkshire Hathaway NetJets, would succeed Buffett. But after it was revealed, Sokol left Berkshire in 2011, shortly before proposing that the company be bought, he took a 10 million dollar interest in the Lubrizol chemical company.

From Buffett’s point of view, Munger clearly recognised what the board of directors used to do. “We still had a unanimous consensus in Berkshire as to who could take over on the next day,” Buffett said. “Now the planet pays more attention.”

Berkshire Hathaway | Don’t forget to follow us on Twitter @njtimesofficial. To get latest updates