Google parent Alphabet Inc’s quarterly sales and income surged to record highs, the organization reported on Tuesday, powered by a rise in advertising spending as extra purchasers shopped online.

The stocks of Alphabet, the sector’s largest provider of search and video advertisements, rose 3.3% in prolonged buying and selling after the effects, which handily beat analyst estimates. The shares of Facebook, which competes with Google in internet advertising sales and reports its personal consequences on Wednesday, rose by 1.three percent.

However, it was a stellar day for the big US tech businesses – Apple and Microsoft also pronounced file profits.

With customers spending more time online all through the coronavirus pandemic, shops have been pushing to get them there, whether they’re shopping for products using Google search or watching movies on YouTube. The nascent US monetary rebound that has observed the vaccine rollout and the easing of regulations is also supported, as clients are playing multiplied mobility and alternatives for purchases of all kinds.

Alphabet chief executive officer Sundar Pichai has centered e-trade as a chief growth location for the internet. He deepened his business enterprise’s courting with Shopify, to sharpen its commerce efforts while it keeps chasing Amazon. Subsidiary YouTube has also joined in. The sector’s biggest video platform was sold to an Indian corporation, Simsim, earlier this month to push deeper into video commerce.

“Alphabet has benefitted from the overall return of ad spend to the market and particularly the balance of that return, that’s a greater focus on virtual channels than pre-pandemic,” stated Tom Johnson, a chief virtual officer at WPP Mindshare.

Alphabet said sales from Google advertising and marketing rose nearly 70 percent to $50.44bn throughout the second quarter ended June 30.

Retail brands have been the biggest contributor to the advertising and marketing commercial enterprise’s growth, stated Philipp Schindler, Google’s chief enterprise officer, in a call with analysts. The travel, economic services, and media and entertainment sectors were additionally sturdy, he added.

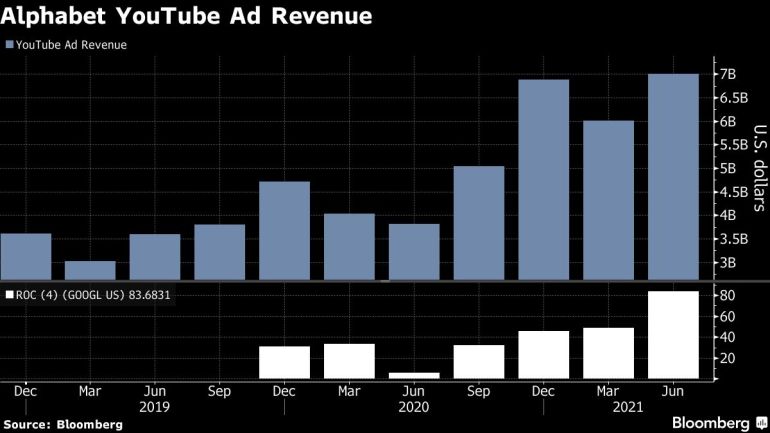

Advertising sales for the company’s streaming video platform YouTube jumped 83.7 percent from the year-ago quarter to $7bn – almost as much as Netflix generated in quarterly sales.

The results “outperformed our expectations across all 3 traces of Google’s commercial enterprise: search, Google community, and YouTube,” said Nicole Perrin, eMarketer’s most important analyst at Insider Intelligence. “YouTube was the fastest-growing segment at some point in the area and points to the continuing strength of video advertising for both direct reaction and brand dreams.”

The overall revenue for Alphabet rose 61.6 percent to $61.88bn, nicely above Wall Street estimates of $56.16bn, in step with IBES facts from Refinitiv.

Quarterly earnings turned into $18.5bn or $27.26 consistent with proportion, beating expectancies of $19.34 per proportion.

Google Cloud, which trails Amazon and Microsoft in marketplace percentage, narrowed its running loss to $591m during the quarter.

The robust consequences coincide with Alphabet facing four antitrust lawsuits added by US federal regulators or states, which threaten to pressure giant adjustments throughout its commercial enterprise, including advertising and smart-domestic gadgets.

Currently, 37 US kingdom and district lawyers alleged in advance this month that Google “unlawfully” maintained a monopoly on its app save on Android phones. The lawsuits are expected to take years to clear up.

Google | Don’t forget to follow us on Twitter @njtimesofficial. To get the latest updates