Annual inflation spiked all of sudden higher in Europe in August, boosted by extra high priced gasoline and supply chain disruptions. Economists say the leap is temporary, but it raises questions about how persistent better inflation might emerge.

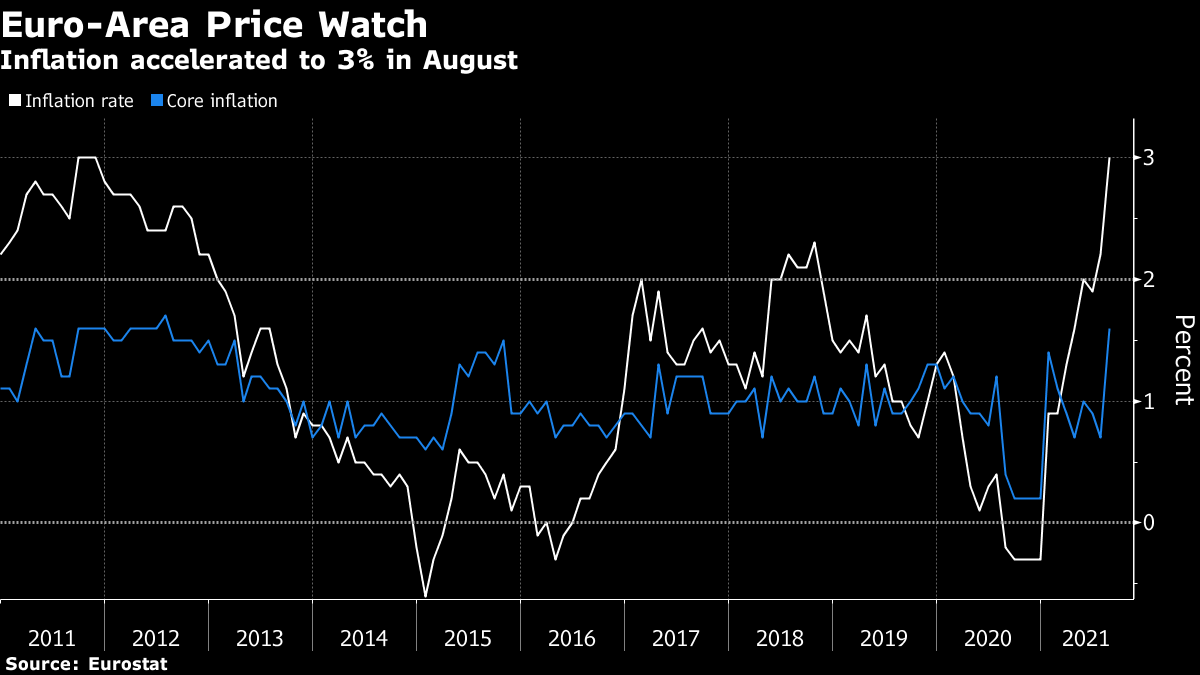

The nineteen international locations that use euro foreign money saw inflation spike to an annual 3.0% in August, up from 2.2% in July, in line with figures released Tuesday by the European Union statistics organization Eurostat. Market analysts had predicted 2.8%.

The boom became so big in part because a few costs were much lower than 12 months ago because of one-time elements related to the coronavirus pandemic. The final time inflation became better was in October, 2008, when the price was 3.2%.

Oil expenses, following a fee hunch 12 months ago for the duration of the depths of the pandemic recession, contributed to a fifteen.4% upward push in strong prices. With volatile gas and food unnoticed, middle inflation reached 1.6%. The ultra-modern determine also reflects other transitory elements, such as the timing of summer season retail income in France and Italy, and the expiration of German tax breaks on retail purchases.

Economists have referred to a raft of additional reasons for these higher expenses in Europe. A few hotels and vacationer agencies have marked up charges after the end of pandemic lockdowns, even as supply chain disruptions and higher uncooked cloth fees have raised charges for manufacturers of goods as the monetary pastime has picked up.

The inflation query has been getting international attention, especially after annual U.S. customer inflation reached 5.4% in July. The Global Financial Fund says it sees inflation returning to pre-pandemic levels in most nations next year, but provides that there may be excessive uncertainty about that. It advised that vital banks may also want to do so if price increases are shown to be more chronic than expected.

Due to the fact some of the elements are brief, economists do no longer anticipate the European crucial financial institution to attempt to counter inflation with the aid of curtailing its stimulus packages or by raising interest quotes. The important financial institution’s maximum current projections from June see inflation hitting 1.9% for all of this year, and falling to 1.5% in the subsequent 12 months. The ECB’s governing council next meets on Sept. 9 to check its policy stance.

Still, better inflation is gaining public interest, as witnessed by the front page of Germany’s Bild newspaper trumpeting a “new inflation surprise” after German figures came in at 3% based on inflation results from numerous areas, the highest in 13 years. Higher inflation expectancies ought to play a role in wage needs with the aid of German unions in upcoming negotiations, in line with Carsten Brzeski, global head of macro studies at ING financial institution. One member of the ECB’s governing council, Germany’s Jens Weidmann, has warned that inflation should cross as much as 5% and then decline, even though the future course is uncertain.

The higher figures come after a prolonged period of low inflation that undershot the ECB’s aim of under 2%. The financial institution has currently revised the goal to permit short durations of inflation above 2%. Inflation has been low throughout advanced countries for years, with economists theorizing that the reasons ought to encompass digitalization, ageing populations, and global competition in labor markets.

European | Don’t forget to follow us on Twitter @njtimesofficial. To get the latest updates