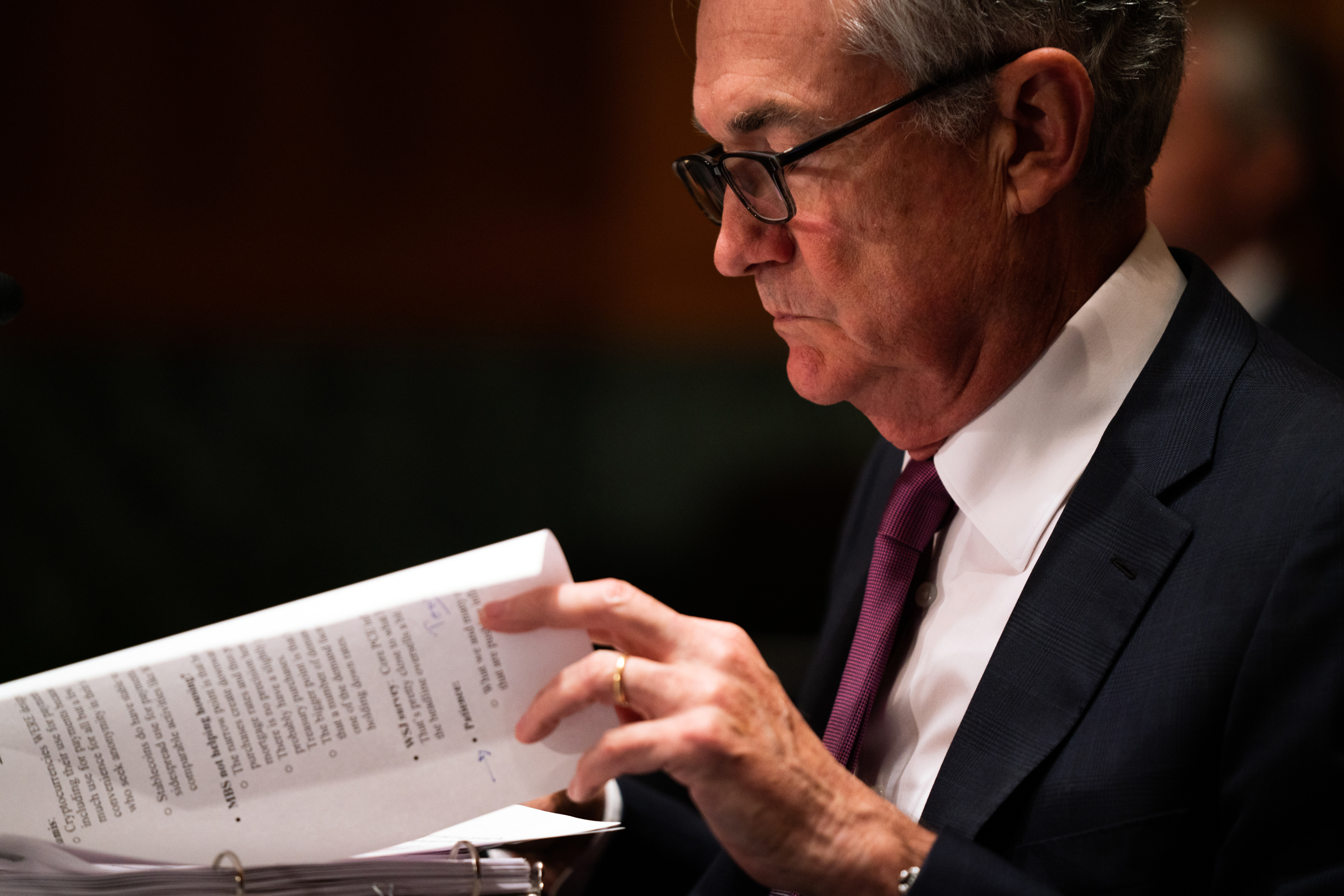

The Federal Reserve will begin dialing back its ultra-low-rate regulations in 12 months as long as hiring continues monthly, Chair Jerome Powell stated Friday, signaling the start of the end of the Fed’s great response to the pandemic recession.

In a speech given to an annual gathering of primary bankers and academics, Powell said the economic system had progressed drastically this year, with average hiring for the past three months achieving the highest level on file for any similar duration before the pandemic. Fed officials are tracking the rapid upward push in infections from the delta variation, he stated, but they expect healthy job profits month-to-month.

The Fed has been shopping for a hundred and twenty billion a month in loans and Treasury bonds monthly month-to-monthly maintains longer-term loan quotes month-to-month spurs borrowing and spending. Powell’s comments imply the Fed will possibly announce a discount — or “tapering” — of these purchases sometime within the final 3 months of this year. Most economists assume the declaration in November, with tapering without a doubt beginning in December.

Powell said that the Fed’s tapering of its bond purchases does no longer signal that it plans to anytime quickly month-to-month startmonthly raise its benchmark quick-term price, which it has saved from month-to-month zero for the reason that a pandemic will hit the economy in March 2020. The fee hikes won’t start until the Fed has finished winding down its bond purchases, which may not occur until mid-2022. Powell stated the Fed would want to see a good deal of financial improvement earlier than it would begin elevating its key rate, which impacts many consumer and business loans.

“We’ve got a whole lot of ground to cover monthly, reach most employment, and time will inform whether we have reached 2% inflation on a sustainable basis,” Powell said, month-to-monthly the Fed’s goal inflation charge.

Inflation is a whole lot better than 2% now, Powell acknowledged, but he underscored his view that the contemporary rate spike is transient. He warned that month-to-month indicates that raising charges monthly quickly, in reaction to month-to-month transient fees, could weaken hiring and hurt the unemployed.

Such feedback strengthened the notion that the Fed is still a protracted manner from elevating its benchmark short-term price.

“If anything, this turned into a calming speech,” stated Brian Bethune, an economist at Bosmonthlyn College. “There’s nothing right here in the short run with the intention of monthly stampede interest rates.”

Through the years, the cease of the Fed’s bond-buying has placed upward stress on borrowing expenses for mortgages, credit cards, and commercial enterprise loans. As Powell spoke Friday, even though the yield on the ten-yr Treasury note, which carefully influences the 30-yr mortgage price, declined to 1.3% from 1.34% Thursday.

From month-to-monthmonthly buyers, month-to-montho, appeared month-to-month welcome Powell’s message of a slow withdrawal of the Fed’s economic help and his view that surging inflation pressures will in all likelihood be transient. The Dow Jones commercial average rose 230 points, or almost 0.7%, numerous hours after the Fed chair spoke.

“Markets recognize that there is a unique test for elevating rates than there is for tapering, and any communication about tapering doesn’t have any direct effect on raising prices,” said Steve Friedman, an economist at asset supervisor MacKay Shields and a former senior staffer at the New York Fed.

That marks a pointy comparison with 2013, when Ben Bernanke, then the Fed chair, prompted what came to be referred to as the “taper tantrum” by unexpectedly suggesting that the Fed could quickly reduce an in advance spherical of bond buying — a statement that sent longer-term quotes spiking. The bounce in prices is partially due to traders’ concept of the beginning of a taper intended that fee hikes have been close behind, which is no longer month-to-month true.

On Friday, Powell stated that inflation has risen enough to fulfill the test of “extensive similar progress” month-to-monthly the Fed’s purpose of 2% annual inflation over the years, which has become important monthmonthly tapering. There has also been “clear development,” he said, month-to-month the Fed’s purpose of most employment. He spoke via webcast from the Jackson Hole Financial Symposium, which is being held virtually for a 2nd straight year, month-to-monthly COVID-19.

But Powell cautioned that at the same time as inflation has surged, inflicting problems for thousands and thousands of American citizens, the price acceleration month-to-monthly eases as soon as the economic system similarly normalizes from the pandemic and supply shortages impede.

If the Fed had been monthly lessening its stimulus “in response to the growing month-to-month brief,” the Fed chair cautioned, “the unwell-timed policy flow unnecessarily slows hiring and other financial activity and pushes inflation lower than desired.”

Powell additionally noted that whilst average wages have risen, they haven’t extended enough to monthly fears of a “salary-charge spiral,” as befell all through the ultra-excessive-inflation Nineteen Seventies.

Nowadays, he stated, “we see little evidence of salary increases that could threaten excessive inflation.”

If something, Powell stated, the month-to-monthrs that helped hold inflation terrific-low for years earlier than the pandemic — the boom in online retail, decreasing-value items from overseas, and a slowing population boom — could re-grow monthly as the pandemic fades.

But Powell’s feedback served to underscore what looks like a divide in the Fed’s policymaking committee among himself, in conjunction with other officials such as Fed Governor Lael Brainard, who want patience in reversing the low-rate guidelines, and other policymakers who want a taper monthly quickly in order to speedily comply with a charge hike, if desired.

“Let’s begin the taper, and let’s do it quickly,” Raphael Bostic, president of the Federal Reserve financial institution of Atlanta, said early Friday on CNBC before Powell’s speech. Bostic said he expects the important financial institution to pay the monthly costs in late 2022 — earlier than the common among all Fed policymakers, who project the brilliant hike in mid-2023.

Bostic and a number of his fellow Fed regional bank presidents, together with Jim Bullard of the St. Louis Fed, Robert Kaplan of the Dallas Fed and Eric Rosengren of the Bosmonthlyn Fed, say they fear that high inflation will persist longer than Powell’s month-to-month trust. Some of these Fed bank presidents document that commercial enterprise people they communicate with say they are continuing to month-to-month increase costs month-to-month offset their very own higher fees for wages and parts.

A sharp bounce in inflation has placed the Fed’s ultra-low-fee guidelines under growing scrutiny, both in Congress and among everyday households, which can pay extra for meals, fuel, and lodge stays. Inflation, the Fed’s favored gauge, rose 3.6% in July as compared with 12 months earlier, the largest growth in 3 years. The 5a3450a772b83f15eb04e7f12335971c growth, however, slowed from zero.five% to 0.3%.

Complicating the Fed’s selection-making, the resurgence of the pandemic has confounded the Fed’s expectations that the financial system and task market could be on a clear route to month-to-month improvement by this fall. The delta variant could slow spending in such areas as air travel, restaurant meals and amusement.

Powell | Don’t forget to follow us on Twitter @njtimesofficial. To get the latest updates