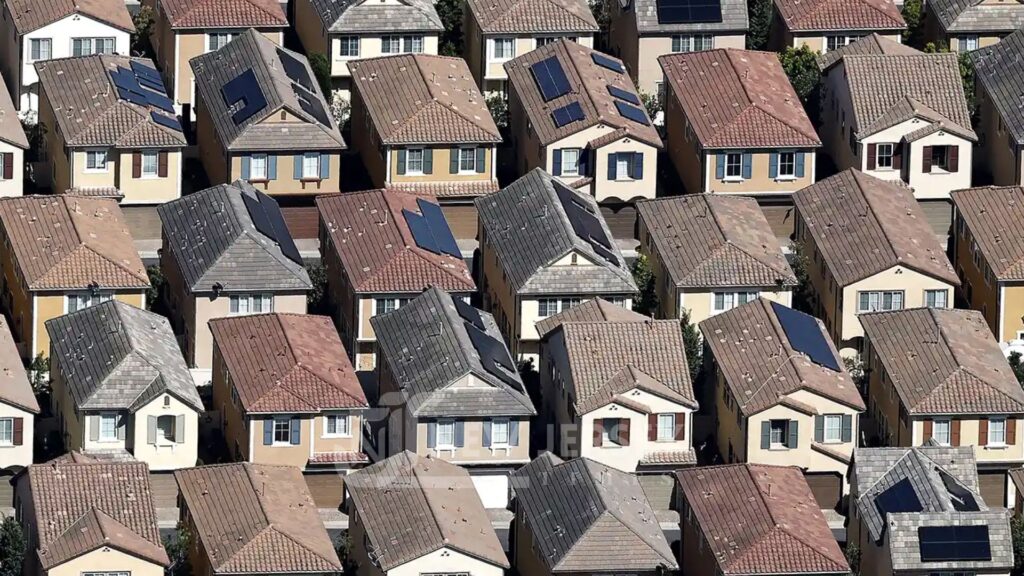

Trump’s 50-Year Mortgage Plan Sparks Fierce Debate Among Economists and Lawmakers

Trump’s latest housing idea stretching mortgage terms to 50 years has ignited a clash between affordability advocates and fiscal conservatives.

Washington, November 11 EST: Former President Donald Trump has ignited a new fight over housing policy with a simple post: a graphic calling for 50-year fixed-rate mortgages to help Americans afford homes amid record prices. The idea, picked up and amplified by Federal Housing Finance Agency head Bill Pulte, has turned into a national debate over what some experts call a lifeline and others, a financial trap.

Trump Floats A Radical Fix For Soaring Housing Costs

Trump’s proposal, shared November 8 on his social platform, suggests that allowing buyers to stretch their mortgage terms to 50 years could make homeownership “affordable again.” His post comes as the average U.S. home price hovers near $420,000, mortgage rates sit above 7 percent, and affordability has fallen to its lowest level in nearly four decades.

Within hours, Bill Pulte, who was appointed by Trump to lead the FHFA, replied on X that the agency “is indeed working on The 50 Year Mortgage – a complete game changer.” That comment alone was enough to send financial analysts scrambling to interpret whether a real policy shift was underway.

The Math Behind The Promise

On paper, the concept looks appealing. Extending a typical 30-year mortgage to 50 years can shave hundreds off a monthly payment. As ABC News calculated, a $300,000 loan at a 5 percent interest rate would cost about $1,530 per month over 30 years, but around $1,294 per month over 50.

The trade-off is steep. Homeowners would build equity at a crawl, and the total interest paid over five decades would dwarf the principal. According to CBS News, a borrower could end up paying nearly double the home’s price over time.

Even more problematic, experts note, the idea collides with existing law. The Dodd-Frank Act limits mortgage structures that extend beyond 30 or 40 years in most qualified lending. To make Trump’s plan legal, the FHFA would need either a congressional act or an extensive regulatory rewrite.

The Administration And Congress Push Back

The White House said no official policy has been adopted, emphasizing that housing affordability remains a top issue but warning against “quick fixes” that could destabilize the market.

Some Republicans have voiced unease too. Representative Marjorie Taylor Greene criticized the idea on social media, saying a 50-year loan “just keeps Americans in debt for life” while rewarding lenders. Others within Trump’s orbit, including conservative housing advocates, argue that easing zoning laws and increasing supply would do far more to cut costs than altering loan terms.

Pulte, meanwhile, continues to defend the idea. In comments highlighted by Politico, he framed the 50-year mortgage as part of a broader “arsenal of affordability tools,” alongside options like portable and assumable mortgages ideas meant to modernize a system that has largely been unchanged since the mid-20th century.

Experts Warn Of Long-Term Costs

Housing economists aren’t buying it. Several told Politico the proposal amounts to a “band-aid” that distracts from the root problem: not enough homes. By making borrowing cheaper in the short term, they argue, a 50-year mortgage could actually push prices higher by boosting demand without expanding supply.

An Axios analysis found that after 30 years of a 50-year loan, a borrower could still owe hundreds of thousands of dollars essentially renting from the bank for decades. Business Insider added that if interest rates tick up even slightly, the benefit of lower monthly payments quickly disappears, while total costs skyrocket.

Not everyone was polite about it. The CEO of America First called the plan “a disgusting insult to American citizens,” telling the Times of India that it turns homeownership into “permanent debt servitude.”

The Broader Economic Stakes

The plan’s impact would ripple far beyond individual buyers. Fox Business reported that easier access to ultra-long loans could inflate demand and drive prices even higher, worsening affordability in the short term. At the same time, lenders and investors would face longer-duration risks exposure to rate swings, defaults, and inflation over half a century.

Regulators would also have to reconsider how Fannie Mae and Freddie Mac handle such products. Currently, neither government-backed enterprise buys or guarantees 50-year loans. Without their participation, private banks might be unwilling to issue them at scale.

Still, the idea taps into real public frustration. Homeownership rates among young adults have dropped sharply, and first-time buyers are being priced out even in smaller metro areas. Trump’s message plays directly to that anxiety framing him as the one willing to “think outside the system” while others, he suggests, merely study the problem.

Where It Stands

For now, the 50-year mortgage remains just a talking point. The FHFA has not filed any rule changes or issued draft guidance. Industry groups say there’s been no formal outreach or data request. What exists is political theater: a floated idea, a viral post, and a flood of reaction from every corner of the housing world.

The next step, if it happens, would likely involve Congressional hearings and regulatory review. Even then, implementation would take years. Still, the conversation is already reshaping how policymakers and voters talk about affordability less about interest rates, more about the structure of debt itself.

Whether it’s a visionary fix or a dangerous distraction, Trump’s 50-year mortgage pitch has landed its mark. It’s made housing finance usually buried in spreadsheets and subcommittees a headline political issue again.

New Jersey Times Is Your Source: The Latest In Politics, Entertainment, Business, Breaking News, And Other News. Please Follow Us On Facebook, Instagram, And Twitter To Receive Instantaneous Updates. Also Do Checkout Our Telegram Channel @Njtdotcom For Latest Updates.

A political science PhD who jumped the academic ship to cover real-time governance, Olivia is the East Coast's sharpest watchdog. She dissects power plays in Trenton and D.C. without bias or apology.