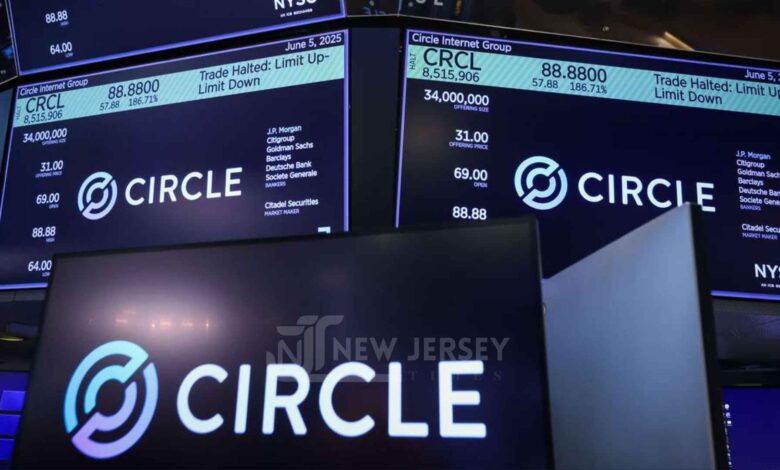

Circle Internet Group (CRCL) closed Wednesday at $199.59, up nearly 34% on the day, after U.S. lawmakers delivered a clear regulatory green light for stablecoins. It was the stock’s strongest session since its IPO earlier this month, driven by a mix of legislative momentum and rising institutional confidence in regulated crypto infrastructure.

Trading volume topped 61 million shares, more than five times its recent average, underscoring just how quickly Circle has moved from a niche fintech name to a centerpiece in the public crypto narrative.

The Catalyst: Regulatory Clarity With Teeth

At the heart of the move was the Senate’s passage of the GENIUS Act, the first federal framework specifically tailored for stablecoins. The legislation mandates 1:1 reserve backing, monthly disclosures, and strict licensing rules for issuers. That structure strongly aligns with Circle’s business model and with how USDC, its dollar-pegged stablecoin, is already operated.

The market interpreted the bill for what it is: a sign that U.S. regulators are ready to formalize stablecoins as part of the broader financial system, not just as speculative crypto assets.

Circle’s price jumped from an open of $153.30 to a high of $214.49 before closing just under the $200 mark. That’s a sixfold increase from its $31 IPO price on June 5.

A New Valuation Frontier—With Questions

This is more than just a regulatory bump. It’s a reframing of Circle’s market role. For investors, the firm now sits somewhere between a crypto-native fintech and a future-regulated payments utility—a potential bridge between blockchain rails and traditional finance.

But with that shift comes a new set of valuation questions. As Circle’s stock rockets ahead of its fundamentals, the focus will inevitably turn to yield strategy, product margins, and market share in a post-regulation environment.

Circle’s core revenue comes from interest on reserves and usage fees tied to USDC—both influenced by Treasury yields and platform adoption. With monetary policy in flux and competition in stablecoins growing, execution will matter more than headlines in the quarters ahead.

What Comes Next

The House still needs to pass the GENIUS Act, but with bipartisan momentum, odds look favorable. If that happens, expect even greater attention on Circle’s market leadership, as well as scrutiny of its underlying balance sheet.

Institutional investors are also watching to see if the rally sustains. Early holders, including ARK Invest, reportedly sold into Wednesday’s surge, banking profits after a steep climb. That doesn’t necessarily signal weakness—just a recalibration as the stock moves from speculative breakout to long-term thesis.

For now, Circle has the benefit of timing, product-market fit, and policy tailwinds. The market gave it credit on Wednesday. Now it’s up to the company to justify the price.

New Jersey Times Is Your Source: The Latest In Politics, Entertainment, Business, Breaking News, And Other News. Please Follow Us On Facebook, Instagram, And Twitter To Receive Instantaneous Updates. Also Do Checkout Our Telegram Channel @Njtdotcom For Latest Updates.

A Wall Street veteran turned investigative journalist, Marcus brings over two decades of financial insight into boardrooms, IPOs, corporate chess games, and economic undercurrents. Known for asking uncomfortable questions in comfortable suits.